Certified payroll is a specialized payroll report required for companies working on government-funded construction projects, such as affordable housing. In this report, the construction company must include all necessary details about the workers involved in the project: the type of job each worker performed, the hours they worked, and information on when and how they were paid. This payroll report must be prepared and submitted weekly to the government agency funding or overseeing the project. For affordable housing projects, it is typically submitted to the government housing authority overseeing the work.

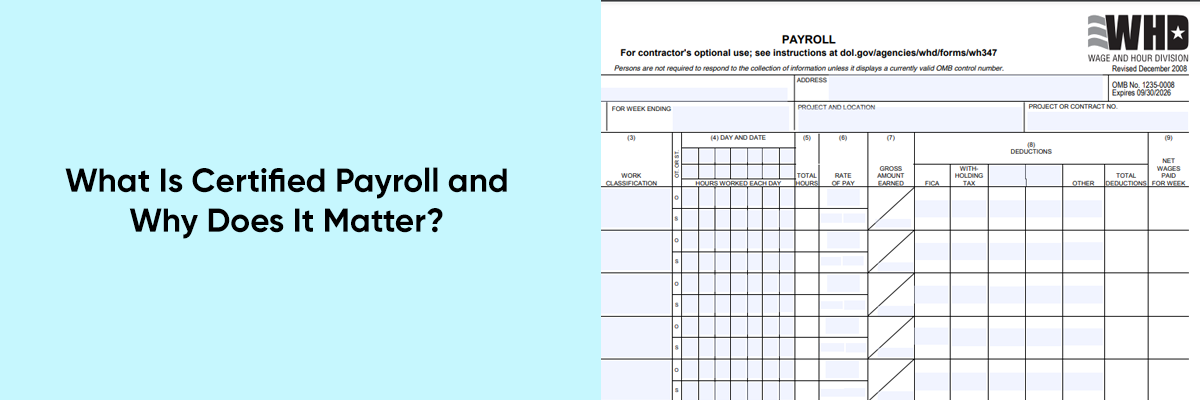

Form WH-347: Certified Payroll Reporting

Certified payroll typically involves completing a specific form known as Form WH-347. This standard form, provided by the U.S. Department of Labor, serves a crucial purpose: it captures all necessary details regarding payroll in a single document, ensuring compliance with federal and state labor laws.

The information included on Form WH-347 typically comprises the following sections:

- Employee Information: This section includes essential details about each worker, such as their full name, address, and Social Security Number or Employee Identification Number.

- Employment Details: Here, you’ll specify the job classification (e.g., laborer, electrician) and the pay rate, whether hourly or salary-based.

- Total Hours Worked and Earnings: This part of the form outlines the total hours each employee worked, encompassing both regular and overtime hours, along with the gross wages earned before any deductions.

- Deductions: This section provides a summary of all withholdings, such as federal and state taxes, insurance premiums, and retirement contributions.

- Net Pay: This is the final amount that each employee receives after all deductions have been taken into account.

- Payment Information: You will also indicate the payment date and method (e.g., direct deposit or check) in this section.

- Fringe Benefits: It includes the type and value of fringe benefits provided, such as health insurance or retirement contributions.

- Project and Compliance Information: This section identifies the project name and number, along with the government agency funding the project, ensuring all parties are aware of compliance with the Davis-Bacon Act.

By using Form WH-347, contractors and subcontractors can ensure that all required information is presented consistently and clearly. This facilitates easier auditing and compliance checks by federal and state agencies, thereby upholding the rights of workers and maintaining the integrity of labor practices.

If the form does not have enough rows to accommodate all workers, you can print additional copies of Form WH-347. Each form should include the same project and payroll period information at the top.

Here is a link to Form WH-347 PDF file, where you can check and see all the details that you need to fill out. Just download the form and add all the necessary information and recheck all the information and sign the form and make it ready to submit.

Submission Process

- Identify the Right Agency

First things first: figure out which federal agency is funding or overseeing your project. You can usually find this info in your project contract.

- Submitting the Form

Now, when it comes to getting that WH-347 submitted, you’ve got a few options to keep it simple:

- Mail: Print out those completed forms and send them off to the federal agency’s address. Don’t forget to keep a copy for yourself—just in case!

- Email: Some agencies are cool with electronic submissions. Check in with them to see if this is an option and follow their guidelines.

- Online Portal: If the agency has a digital submission system, just follow their steps to upload your form. Easy peasy!

Make sure to stick to the weekly submission schedule so you stay compliant and avoid any headaches later on!

Importance of Certified Payroll

There are several reasons why certified payroll is important, and below we have listed all the key points.

- Compliance with Laws: Ensures adherence to federal and state labor laws, such as the Davis-Bacon Act, preventing legal penalties.

- Transparency: Provides a clear record of wages and hours worked, fostering trust between employers, employees, and government agencies.

- Fair Compensation: Guarantees that workers receive the correct prevailing wages and fringe benefits for their roles in federally funded projects.

- Quality Control: Helps maintain high standards on construction projects by ensuring that only qualified workers are employed.

- Accountability: Establishes a system of checks and balances, making contractors accountable for their payroll practices.

- Funding Justification: Provides necessary documentation to justify the use of federal funds, ensuring that taxpayer money is spent responsibly.

- Audit Preparedness: Facilitates smoother audits by maintaining organized and accessible payroll records.

- Worker Rights Protection: Safeguards the rights of workers by ensuring they receive fair pay and benefits.

- Project Oversight: Aids government agencies in monitoring compliance and progress on public works projects.

- Reputation Management: Enhances the reputation of contractors by demonstrating commitment to fair labor practices and ethical standards.

We hope you find this blog informative and helpful, enhancing your knowledge on topics like payroll, affordable and fair housing, and more. If you’re interested in learning more, check out our webinar pages, where you’ll find on-demand and upcoming webinars led by industry experts. These sessions are designed to enhance your knowledge and skills, elevate your career, help you with compliance, and minimize mistakes, allowing you to work as smoothly as possible.

Conclusion

In summary, understanding certified payroll is essential for contractors and subcontractors involved in government-funded projects. By diligently completing Form WH-347, you ensure compliance with labor laws, promote transparency, and protect workers’ rights. The importance of accurate payroll reporting extends beyond legal requirements; it enhances project oversight and fosters trust between all parties involved.

We encourage you to explore the resources available, including our informative webinars, to deepen your knowledge on payroll and related topics. Staying informed and compliant not only benefits your organization but also contributes to the overall integrity of the construction industry.